Inflation Reduction Act for Non-Profits

Enabling Transition to Renewable Energy

The Inflation Reduction Act of 2022 is a pivotal piece of legislation in the U.S. aimed at accelerating the transition to renewable energy sources, with a strong focus on solar power. This act is part of a larger commitment by the federal government to tackle climate change and promote sustainable energy practices, which falls right in accordance with the values of Commercial Solar. The allocated $369 billion for energy and climate change investments over the next decade is a testament to this commitment.

This funding is designed to provide substantial financial support to a wide range of entities, including businesses, non-profit organizations, and municipalities, encouraging them to invest in solar energy solutions. The act not only underscores the importance of transitioning to renewable energy for environmental sustainability but also aims to make solar energy more financially accessible and attractive.

Inflation Reduction Act for Non-Profits Helping Commercial Solar

A Good News for Solar Energy Adopters

One of the key features of the IRA is its provision of financial incentives, such as tax credits and cash payouts, which significantly lower the barrier to entry for adopting solar energy. For businesses and nonprofits, this could mean a considerable reduction in the initial investment costs associated with solar project installations.

Municipalities, on the other hand, stand to benefit from the opportunity to integrate solar power into their energy mix, thus reducing their carbon footprint and setting a precedent for sustainable community development. The act’s focus on solar energy also aligns with the broader global trend towards cleaner energy sources and positions the U.S. as a leader in the fight against climate change. By incentivizing the adoption of solar power, the IRA is not only contributing to the reduction of greenhouse gas emissions but also fostering innovation and growth in the renewable energy sector.

Understanding the Investment Tax Credit (ITC) and Production Tax Credit (PTC)

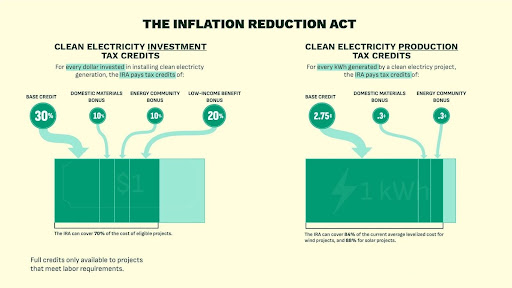

The Investment Tax Credit (ITC) and Production Tax Credit (PTC), as part of the Inflation Reduction Act (IRA), play crucial roles in making solar energy projects more viable and financially attractive for commercial entities. These tax incentives are designed to lower the cost barriers associated with renewable energy investments and spur growth in the solar industry.

Investment Tax Credit (ITC) – A Closer Look

The ITC is a significant financial tool for commercial solar projects, offering a dollar-for-dollar tax credit.

Basic Benefit

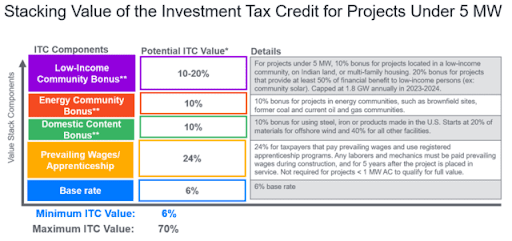

The most prominent feature of the ITC is that it provides a 30% tax credit of the total project cost. This is a substantial incentive, as it directly reduces the tax burden for the year in which the solar system is commissioned.

Duration and Phase-out

The 30% rate is guaranteed until at least 2032. The phase-out of this credit is linked to environmental targets; it begins once greenhouse gas emissions are reduced by 75% relative to 2022 levels. This linkage underscores the ITC’s role in promoting environmental sustainability.

Expansion to Cover Additional Aspects

The ITC’s scope has been broadened to include battery storage systems and all interconnection costs for projects less than 5 MWac. Furthermore, the act introduces a direct pay option for state and tribal governments and certain tax-exempt entities. This direct pay feature is particularly beneficial for organizations that do not have a significant tax liability, as it allows them to receive the incentive as a cash payment, making solar projects more financially feasible.

Request a Commercial Solar Proposal for Your Business

Production Tax Credit (PTC) - Detailed Insights

The PTC is another pathway for incentivizing solar energy, particularly beneficial for large-scale projects.

Applicability

Primarily aimed at larger commercial or utility-scale solar installations, the PTC differs from the ITC as it is based on the actual amount of renewable electricity generated by the system.

Calculation Method

The value of the PTC is calculated based on the electricity produced by the solar system. For smaller projects (under 1 MWac), the rate is $0.027 per kilowatt-hour (kWh), while larger projects that meet the prevailing wage requirement receive a slightly lower rate of $0.021 per kWh. These values are subject to change in the future, indexed to inflation, ensuring that the PTC remains a relevant incentive over time.

Individual Assessment for Maximum Benefit

To determine whether the ITC or PTC is more beneficial for a specific project, an individual assessment is essential. This assessment should take into account factors like the size of the system, eligibility for additional credit adders, and the net present value of the tax credits over the system's operational lifetime.

Investment Tax Credit (ITC) and Production Tax Credit (PTC)

Special Incentives for Non-Profit Organizations

The Inflation Reduction Act (IRA) brings several beneficial provisions for non-profit organizations, enhancing their capacity to invest in solar energy. These provisions not only ease the financial burden but also incentivize sustainable practices. Here's a detailed look at these provisions:

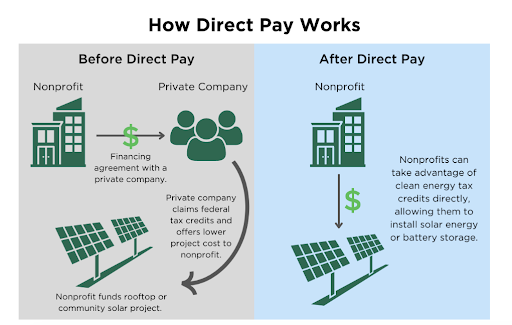

Direct Pay for Non-Profit Entities

Mechanism

Non-profit organizations, which typically do not benefit from tax credits due to their tax-exempt status, can now receive direct payments from the IRS equivalent to what they would have earned in tax credits.

Impact

This direct pay approach simplifies the investment process in solar energy for non-profits. By receiving cash payments, these organizations can directly offset the costs of solar installations, making renewable energy projects more viable and appealing.

How Direct Pay works under the IRA?

Transferability of Tax Credits

Functionality

The IRA allows for the transferability of solar project-related tax credits. This means that nonprofits can sell their earned tax credits to other entities through a market-based system.

Benefit

This provision offers flexibility and a potential revenue stream for non-profits. It enables them to monetize the tax credits, which can be particularly beneficial for organizations that have limited capacity to use these credits themselves.

Prevailing Wage Standards & Apprenticeship Requirements

Regulations

Starting in 2023, solar projects larger than 1 MWac and all battery storage projects must comply with new wage and labor standards, including paying locally-prevailing wages and employing apprenticeship labor, to qualify for the base 30% federal tax credit.

Purpose

These requirements aim to ensure fair labor practices and workforce development in the solar industry, aligning with broader social and economic goals.

ITC Project Adders

Criteria for Additional Credits

Projects can qualify for additional tax credits if they meet specific criteria. These include using American-made materials and being located in designated areas such as energy communities or low-income areas.

Implications

These adders encourage the use of domestic materials, supporting the U.S. economy, and promote solar projects in areas that might benefit most from renewable energy investments.

Increase ITC Value

Accelerated Depreciation

MACRS

The Modified Accelerated Cost Recovery System allows for the entire cost of the solar system to be written off in the first year of service, despite its useful life of over 30 years.

Advantage

This accelerated depreciation is a significant financial incentive as it reduces the taxable income of the organization in the year the solar system is installed, leading to substantial tax savings.

Local Financial Incentives

Variability by Location

The availability and magnitude of local financial incentives for solar projects can vary significantly depending on the geographical location.

Additional Savings

These local incentives, which may include solar renewable energy credits, local grants, utility rebates, and other discounts, can further reduce the overall investment in solar projects.

Let Commercial Solar Navigate the IRA For You

Navigating the complexities of the Inflation Reduction Act (IRA) can be a daunting task, especially for organizations unfamiliar with the intricacies of tax credits, renewable energy legislation, and financial incentives. This is where the expertise of Commercial Solar comes into play. With a deep understanding of the IRA and its implications for solar energy projects, Commercial Solar is perfectly positioned to guide organizations through the process.

Partnering with Commercial Solar offers organizations a streamlined, informed path through the IRA’s complexities. Their expertise not only simplifies compliance and maximizes financial returns but also ensures that organizations contribute effectively to a sustainable and renewable energy future.

Other Information |

|

| Areas Serving: | Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming |

|---|---|

| Services | Commercial Solar Installation

|

| Company Logo: |  |