In the realm of solar energy, the stability of supply chain pricing is paramount for industry growth and sustainability. Here, we delve into recent trends and projections that indicate a potential stabilization in pricing within the solar supply chain.

Wafer Price Trends:

Mono PERC M10 and G12 Wafers:

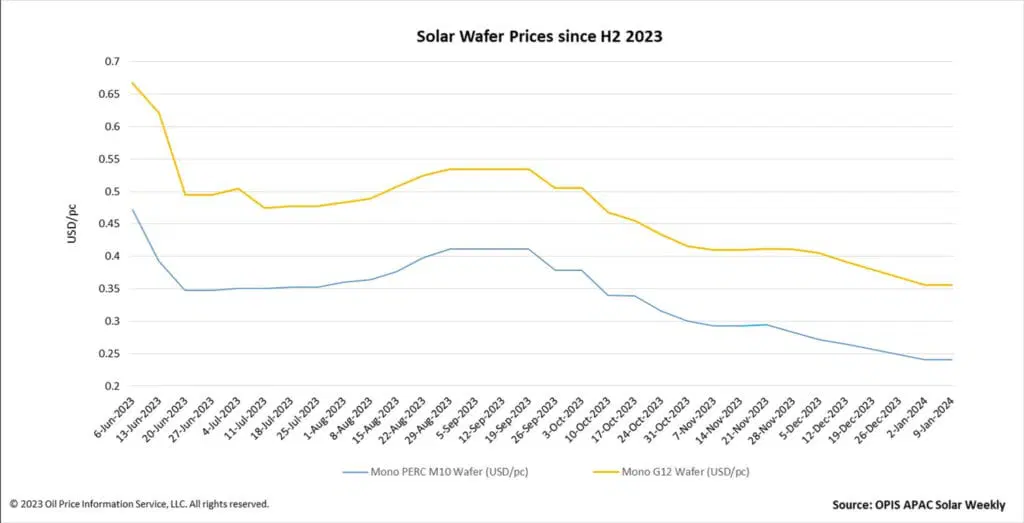

- The FOB China prices of Mono PERC M10 wafers have shown a noteworthy trend, remaining flat at $0.241 per piece (pc).

- Similarly, Mono PERC G12 wafer prices have held steady at $0.356/pc.

Production Projections:

Insights from the Silicon Industry:

- Projections from the Silicon Industry of China Nonferrous Metals Industry Association suggest a nuanced outlook for wafer production in China.

- Anticipated output for January ranges between 54 GW to 56 GW, marking a potential decline of 7.92% month over month.

Industry Response and Analysis:

Navigating Overcapacity Challenges:

- Despite the prevailing issue of wafer overcapacity, manufacturers are strategically managing operating rates to maintain stability.

- Notably, efforts to stabilize production rates underscore the industry’s resilience amidst market fluctuations.

Polysilicon Dynamics:

Cost Implications:

- Polysilicon prices, constituting approximately half of wafer production costs, play a pivotal role in shaping overall pricing dynamics.

- Understanding the interplay between polysilicon costs and market trends is crucial for assessing the broader landscape of solar supply chain economics.

Conclusion:

In conclusion, the analysis of recent trends suggests a potential stabilization in solar supply chain pricing. While challenges such as overcapacity persist, proactive measures by industry stakeholders underscore a collective commitment to fostering resilience and adaptability within the solar energy sector. As the industry continues to evolve, staying abreast of market dynamics and emerging trends will be essential for navigating future uncertainties and unlocking new opportunities for sustainable growth.

By staying informed and proactive, stakeholders within the solar energy ecosystem can collectively drive progress towards a more resilient and sustainable future.